Strategic Value Extraction: Unlocking the Full Potential of Midstream Assets

In the world of midstream energy, assets are engineered for resilience, monitored for compliance, and built to last. But in today’s capital-constrained, M&A-driven environment, the question isn’t if they’ll fail — it’s how far can we push them before replacement is necessary?

This is where the old idea of “sweating the asset” evolves into something far more strategic:

Intelligent asset maximization powered by a robust forecast insights engine.

How Physics-Informed Asset Intelligence maximizes infrastructure returns?

Traditionally, sweating the asset meant maximizing throughput, deferring capex, and stretching asset life — often based on static models and conservative assumptions. This often leads to premature replacement or excessive maintenance, leaving value on the table.

But in today’s environment, where every deferred replacement can unlock $ millions to billions in free cash flow, the game has changed.

KartaSoft works with our client within the Fortune 500 to extend beyond maintaining infrastructure into extracting its full economic potential with Physics-Informed Artificial Intelligence (PIAI).

What KartaSoft Brings to the Table

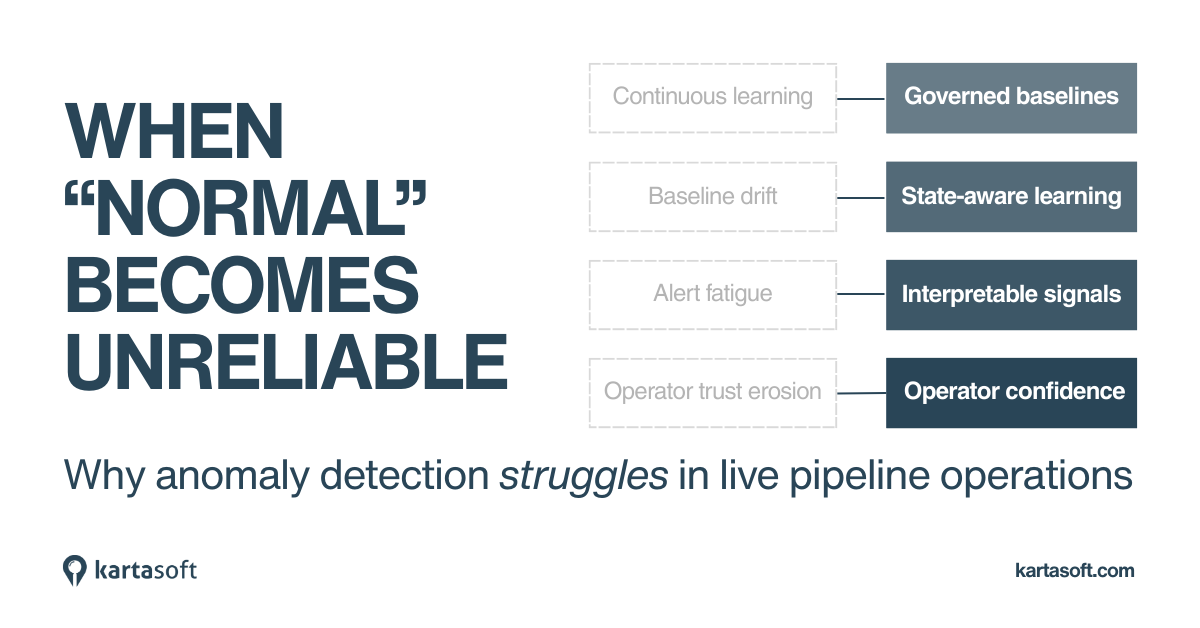

By identifying leaks & anomalies up to 6 months ahead of what was operationally possible, KartaSoft derisks & strengthens capital efficiency. This enables operators to safely defer replacement, optimize maintenance, and maximize asset utilization, all while maintaining regulatory and safety compliance.

Financial Impact: Capital Efficiency at Scale

This science-based approach enables a structured, multi-layered framework for unlocking ROI across the asset lifecycle, from monitoring and maintenance to renewals and portfolio optimization.

For finance leaders in mid-sector energy firms, PIAI has become a strategic lever, by:

- Aligning borrowing with asset cash flows.

- Presenting stronger credit stories to rating agencies.

- Supporting transaction narratives with data-driven asset intelligence.

1. Capex Deferral

Every year of safe life extension on a major pipeline can defer $ hundreds of millions in replacement costs, freeing up capital for debt reduction, dividends, or strategic M&A.

2. Reduced Opex

Targeted maintenance (only where needed) reduces unnecessary spend. Fewer shutdowns mean higher throughput and revenue.

3. Improved Credit Metrics

Higher asset utilization and lower capex improve EBITDA and coverage ratios, leading to tighter bond spreads and better access to forward borrowings.

4. Enhanced M&A Valuations

Assets with demonstrably longer, safer lifespans command premiums in acquisition markets. PIAI becomes a differentiator in due diligence.

KartaSoft gives operators the confidence to push their assets further; CFOs the tools to optimize capital, and investors the assurance of safety and performance.

.jpg?width=750&height=422&name=Blog%20feature%20image%20(4).jpg)

.jpg)

.jpg)

.jpg)